Do You Have To Pay Florida Sales Tax On A Car The Will Be Registered

Practise I Take to Pay a Sales Tax for Ownership a Car?

In general if the state one lives in has sales tax, ane will pay sales tax on the purchase of whatsoever car, including purchase of used cars from a private political party. Sales tax is 1 of the many things that can significantly increase spending on an auto buy. The sales revenue enhancement will exist calculated based on the buy toll of the vehicle and the current tax rate of the city or locality it is purchased in. Equally well, most people pay vehicle licensing and registration fees when they buy a new car.

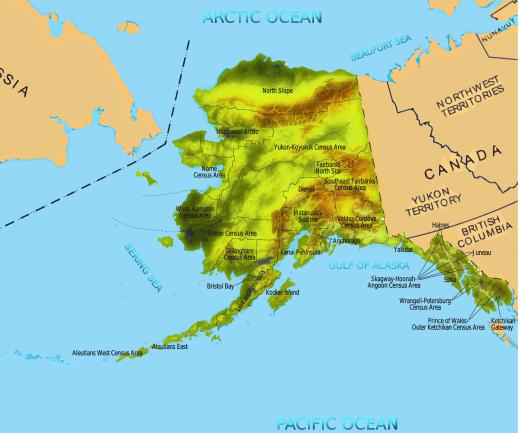

Currently, in the U.s.a., there are five states that don't accept sales taxation. These are Delaware, Alaska, Oregon, New Hampshire and Montana. However, before one thinks of heading to one of these states to buy a car, 1 should know that taxes will be assessed in the state where the auto is initially registered. Thus if a Californian purchases a automobile in Oregon, he or she will have to pay sales tax when registering the motorcar in their home country.

The simply way to avoid paying the tax is by registering the motorcar in the state where 1 purchases it, if the state assesses no sales taxation. This is actually fairly difficult. One must have an address in the state. So if one owned two homes, one in Oregon and ane in California, it would be technically possible to buy a car in Oregon and pay no sales taxation in California.

Nonetheless, people take, in the past, abused this constabulary, and it has led to some crackdowns on vehicle licensing. It is illegal to register a car using a dummy address, for example, an address borrowed from a friend. Generally, if one has an out of country license on a new car, he or she can nonetheless be assessed a tax if he or she really lives in a state with sales tax. Further, one could be charged with revenue enhancement evasion, or pay fines for not registering the car sooner, in one's dwelling state.

If 1 does happen to live in a state with no sales tax, and is planning on purchasing a machine and moving to a state with sales tax, the person should buy the motorcar 90 days prior to moving. This ways ane will non have to pay sales tax when i registers the automobile in the new state. This is not evading the revenue enhancement, only simply being sensible about when to purchase a vehicle if one is considering relocating.

Do You Have To Pay Florida Sales Tax On A Car The Will Be Registered,

Source: https://www.wikimotors.org/do-i-have-to-pay-a-sales-tax-for-buying-a-car.htm

Posted by: hurtyousping.blogspot.com

0 Response to "Do You Have To Pay Florida Sales Tax On A Car The Will Be Registered"

Post a Comment